10 Steps To Start Your Own Commercial Real Estate Appraisal Business

1. Business Documents & Licenses

- Business Entity – Most commercial appraisers form a Limited Liability Company (LLC). However, depending on your circumstances and state of incorporation there may be advantages to forming an S-Corp or C-corp. You should consult with an accountant for ongoing advice on your specific situation.

- You could hire a lawyer to set up your business entity or you can do it online through a website like

LegalZoom.com for as little as $150 (plus your states filing fee which can range from $40 to $612 depending on the state).

- As an additional resource, the

Small Business Administration has a good overview of the various business entity structures.

- Federal EIN – Once you have your business entity set up you will need to get a Federal Employee Identification Number (EIN) which can be done for free in just a few minutes. It’s critical to get a Federal EIN so you can open a business bank account and file your business taxes at the end of the year. The

online Federal EIN Assistant will guide you through the process by asking for your business entity details and then you will receive your Federal EIN immediately upon verification.

- Local Business Licenses

– Depending on the state and city of your new company, a business license may be required and additional taxes may apply beyond state and federal. Check your state and local municipalities to see the applicable laws and requirements. You can also consult an accountant for advice as they should have a good idea of what local regulations and taxes are for businesses.

2. Insurance

- Commercial General Liability (CGL) Insurance – Typically you need a policy that covers $1 million for each occurrence and $2 million aggregate limit. This insurance will cover costs associated with defending against third parties who claim you have caused them financial or physical harm while performing appraisal related services such as causing property damage during an inspection. Expect to pay between $400 and $800 annually for CGL Insurance.

- Errors and Omissions (E&O) Insurance

– You will need to obtain at least a $1 million professional liability policy in order to perform appraisal work for most lenders. This insurance offers coverage for lawsuits related to negligence, omissions, or errors in appraisals. Expect to pay between $600 and $1,800 annually for E&O Insurance with a high deductible, and $5,000+ annually for a policy with a lower deductible.

3. Branding

4. Website & Email

Now that you have a new commercial real estate appraisal company you need to create an online presence and communicate with your clients from a company email address.

- Company Website – The quickest way to get your online website setup is to use a website builder like SquareSpace.com which has hundreds of ready-made templates and is user-friendly so you don’t have to learn how to code to get your new website setup. At a cost of less than $20 per month, you will have a professional website online and available for anyone to see. You can even register a custom website name (domain name) through Squarespace. Or you can purchase a domain name from any domain registrar like NameCheap.com for as little as $10 per year. It’s best to get a .com domain since your clients will be familiar with it and most email systems won’t automatically filter emails to spam or junk email.

- Email

– Get a business email set up with

G Suite (by Google)

so you look professional when sending emails to clients. The cost is $5 per user per month ($50 per user paid annually) for 30GB of storage. If you set up your website using Squarespace then G Suite email can be set up from the settings within your Squarespace page.

5. Bank Accounts

It’s important to keep your business bank accounts separate from your personal bank accounts to ensure that you don’t blur the limitations on liability. This will keep your income and expenses organized so that you can begin accepting money from your clients. When you open a business bank account you can also apply for a line of credit for the company – which can be used to purchase a new work laptop or cover job expenses until you receive payments for appraisals completed.

6. Cloud Document Backup Services

You don’t ever want to lose your data. To protect yourself from data loss, get an online cloud based backup service through

Dropbox.com

for as little as $99 per year per user for 1 terabyte (TB) of space. This should be more than enough space to keep all important appraisal job files safe. As a bonus, you will have access to any of your files from anywhere and any device.

7. Office Services

There are two critical utility services that need to be available and ready to start your commercial real estate appraisal business.

- Phone Service – There are multiple options today for business phones including traditional landlines, voice over internet protocol (VOIP), and cellular phones. Selecting the right option for you will depend on how you plan to run your business, the number of employees, and costs, which can vary substantially from one carrier to another. A landline phone can be as little as $10 per month.

- High-Speed Internet – Slow internet will zap your productivity. Whether you are working from a home office or renting space, consistent access to high-speed internet is a must. Upgrading your home internet will be a big benefit to your productivity so you aren’t waiting for pages to load or slowing down your ability to upload important appraisal files to client portals. You will want a minimum speed of 30mbps with a higher 100+mbps recommended.

8. Data Subscriptions

You are going to need to get several data subscriptions set up so you can support your appraisal reports:

- CoStar – The number one commercial real estate data provider for property and transaction data. The major drawback is it’s a very expensive service with prices varying depending on geographic coverage and services needed. The price of the service can end up costing thousands of dollars a month depending on how many licenses you need. However, they often give discounts to appraisers so talk with your sales representative to understand your options. Realistically you should factor $300 to $600 per user monthly.

- CompStak

– This service is a database for lease and sale comparable data in major metro markets. It’s a FREE service for appraisers, brokers, and researchers. The system works based on submitting lease comparable data to earn credits; then the credits can be exchanged on other lease comparables.

- Demographics

–

STDB

is a great option due to its partnership with the Appraisal Institute. The annual retail fee of $1,295 is cut down to $600 annually with $695 discount through the

Appraisal Institute.

- PricewaterhouseCoopers (PWC)

– This service provides national investment surveys including capitalization rates, discount rates, rent growth, and expense growth projections. The cost is $545 annually.

- Marshall & Swift

– This is the industry standard for construction and replacement cost information. This subscription will be vital for an appraiser to complete a cost approach and insurable replacement cost for appraisal assignments. Plan on spending around $600 annually for your license.

9. Office Software

The industry standard for writing appraisals is Microsoft Office. You can get the software for your business for as little as $10 per month and that will include Word and Excel – the two critical office software components. For a bit more per month ($12.50), you can get the software and your professional email set up on a custom domain (if you haven’t done this already through G Suite in #4). Gone are the days where you had to shell out $200 to $300 to use Microsoft Office. As a bonus with Microsoft 365, you can install the software on up to 5 different computers that you use.

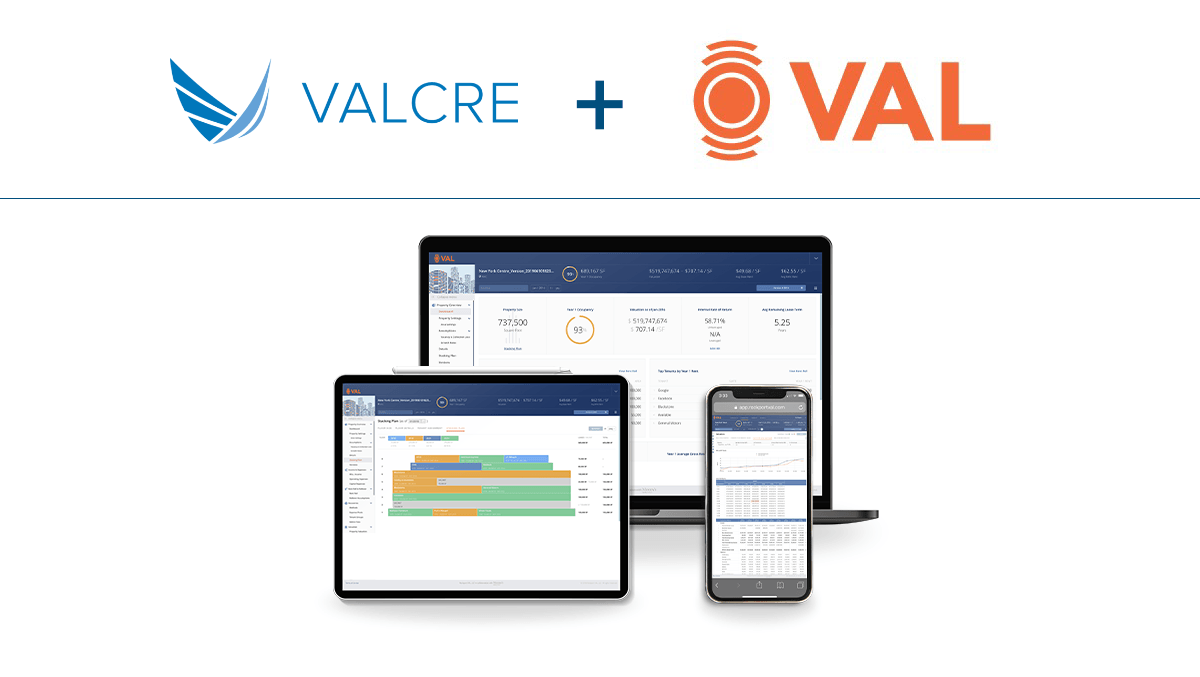

10. Appraisal Platform

A major benefit of working for a big commercial real estate firm is their robust proprietary technology platforms that help make appraisers more efficient. However, now that you are starting your own commercial real estate appraisal business you won’t have that benefit. Or will you? We have one recommendation: Valcre. It’s truly a “turn key” commercial real estate appraisal platform that supports all stages of the appraisal workflow and integrates seamlessly with custom branded Excel and Word templates. With no startup costs and an inexpensive monthly subscription, you get access to a professional job management system, detailed comps database, customizable templates and stunning reports. It’s all secured in the cloud and available anywhere. Check out our features and schedule a demo.