COVID-19 Pandemic Overview, An Appraisers Point of View

Written by Grant Norling, MAI a Valcre co-founder and appraiser in Portland, Oregon

You are free to download and use this this content and use it to help explain the impact of COVID-19 on appraisal assignments you are working on.

Here is the information known about the pandemic and what is being done to mitigate its impacts: Global Pandemic - There is a worldwide COVID-19 pandemic caused by the novel coronavirus that started in December 2019 in Wuhan, China and has since spread across the globe with over 1.5 Million total confirmed cases and 88,444 (rounded) deaths (4/8/2020).

COVID-19

Per the online Merriam-Webster dictionary, COVID-19 is a mild to severe respiratory illness that is caused by a coronavirus (Severe acute respiratory syndrome coronavirus 2 of the genus Betacoronavirus), is transmitted chiefly by contact with infectious material (such as respiratory droplets), and is characterized especially by fever, cough, and shortness of breath and may progress to pneumonia and respiratory failure. Initial findings of this disease indicated that it is as infectious or slightly more infectious than the flu. More recently there is evidence that COVID-19 might be as much as 3 times more contagious than the flu, largely because people can walk around for days either asymptomatic or with only mild symptoms but can be highly contagious. The novel coronavirus can be passed through water droplets (coughing, sneezing or just breathing) within an approximate 6 feet radius and it can be passed by surface contact (contaminated hand to face – eyes nose & mouth). The virus has an ability to stay viable for multiple days on surfaces like plastic and metal, and shorter timeframes such as four to six hours for cardboard and paper. There have been instances of what are called “super-spreading events” where the conditions are perfect for spread of the disease such as choir rehearsal in Washington state where 45 of 60 (75%) attendees were stricken with COVID-19 that attended the two and a half hour practice. Research indicates that under the right circumstances the virus can stay viable while suspended in the air for up to 30 minutes.

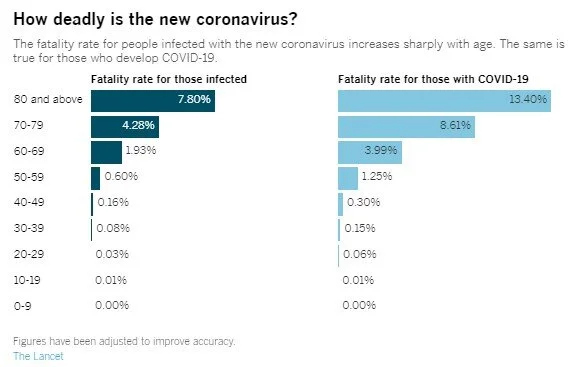

Death Rates

Based on initial findings and depending on location and health factors associated with the population base, the death rate for COVID-19 is somewhere in the 1% to 2% range. An article from the LA Times reports that a recent study indicates a death rate of 1.38% for COVID-19 infections. The actual rate of death lower (less than 1%) because some 25% of cases are asymptomatic and there are many suspected cases that don’t get counted because lack of adequate testing sources. This issue is demonstrated by the graphics below that show death rates by age groups. Young people up to 49 years old have very low death rates. The disease is particularly hard on the elder population and all populations that have pre-existing underlying medical conditions, where a much higher death rate is observed in the most vulnerable risk categories. These are population groups that are a priority for protection. About 80% of the COVID-19 cases are deemed mild or non-severe. Within the non-severe category, it can range from very mild symptoms to symptoms that top the worst flu you have ever had and take weeks to recover from. Severe cases require hospitalization and often utilization of a ventilator as a life saving measure.

Current Epicenters

Europe (particularly Italy, Spain, France & UK) and the United States are currently in all-out battles with the disease with mass social distancing and shelter-in-place ( currently 42 US states ) ordinances, non-essential business closures, spiking unemployment, and growing strain on medical resources. Asian countries have demonstrated the best ability for containment thus far; however, there is still large economic distress occurring due to the stringent measures being taken.

US leads all nations globally with 431,838 confirmed cases and is third with 14,768 deaths. European Countries Spain (148,220), Italy (139,422), Germany (113,296) and France (112,950) round out the top 5 nations in total confirmed cases. Mainland China where the virus originated has the 6th most confirmed cases at 81,804; however, it is largely believed number out of China are not accurate. Italy leads all deaths globally with 17,669.

Last updated: April 8, 2020 at 9:45 p.m. ET

Source: CNN health via Johns Hopkins University Center for Systems Science and Engineering

US Hotspots

In the US, New York, Illinois and Washington state emerged as the early hotspots. Although Illinois and Washington appear to have avoided mass community spread, COVID-19 grew exponentially in New York, which accounts for approximately 35% of all confirmed US cases. New Jersey, Michigan and Louisiana are all experiencing strong surges of infection rates, with none of these states past the anticipated peak. There is widespread community transmission throughout the entire US with new information emerging about areas that are being particularly hard hit.

Medical Resources

Globally and domestically there is a scarcity of medical supplies and resources to combat the COVID-19 pandemic. This includes ventilators, COVID-19 tests, PPE (personal protection equipment), total hospital beds, ICU beds and medical personnel. This is a major issue across all the US from major urban metropolitan areas to the smallest “one horse towns.” Prior to the pandemic crisis, the US medical system was not prepared from a design, scale, and ability to supply resources perspective to react to a national disease epidemic that has wide and deep community spread. The reaction of the medical community, major corporations, and even billionaire citizens has been earth-moving with a race to get the resources in place for US citizens. For instance:

-

General Motors and Tesla are both engineering and manufacturing ventilators. One of the major ventilator manufacturers Medtronic is sharing its portable ventilator specs and code free to all in hopes of rapidly increasing supply.

-

Upon removal of CDC roadblocks, the capacity for testing COVID-19 is ramping up nationally with private companies and hospitals able to develop and administer tests that previously could only be done by the CDC.

-

3M has committed to dramatically ramping up manufacturing of the N95 respirators, which have proven to be the best and most effective solution for protecting medical providers and patients from spreading the virus. Multiple clothing and textile companies are rapidly designing and manufacturing PPE for frontline medical providers.

-

Navy hospital ships recently arrived in New York and California to help cover normal medical care to take pressure off local hospitals that are or are expected to be overwhelmed with caring for COVID-19 patients.

With a massive all-out effort, it is anticipated that medical resources will quickly ramp up in the next couple months to meet the surge in demand.

The Fed

The Federal Reserve is using all monetary policy at their disposal to help prop up the economy. This includes ratcheting down the benchmark interest rate to 0% and going all-in on quantitative easing to ensure there is not a liquidity crunch. Historically low lending rates are anticipated to be ongoing for the foreseeable future. Monetary policy by the Fed and lending policies by banks, credit unions, life companies and the CMBS are not the same. It is anticipated that lending for certain asset types will be impaired for a period including hotels, casinos and retail.

Stocks

After peaking in mid-February at above 29,500, the Dow Jones Industrial Average has experienced tremendous volatility and a sell-off, now sitting at about 23,500 as of the report date. This follows a strong rebound since the Dow went into bear market territory and bottomed out at 18,214 in the last week of February 2020. The strong sell-off corresponded with a comparable increase in cash holdings and government securities. Currently, the market is still fluctuating but is generally stable and waiting for more information before making any major movements up or down.

Source: MarketWatch.com ( 4/8/2020 )

US Government Stimulus

Although initially slow to react, the US Government is aggressively passing emergency legislation to protect the US economy. This is a brief summary of the Government’s countermeasures.

-

Phase 1 (the Coronavirus Preparedness and Response Supplemental Appropriations Act, 2020) was $8.3 Billion to promote Coronavirus vaccine research and development that was signed into law on March 6, 2020.

-

Phase 2 (the Families First Coronavirus Response Act) was about $104 Billion for paid sick leave and unemployment benefits for workers and families that was signed into law on March 18, 2020.

-

Phase 3 and the most recent stimulus known as the Coronavirus Aid Relief and Economic Security Act (CARES) passed in the Senate March 25, 2020, passed in Congress the next day, and then was signed by President Trump that same day. This stimulus is of unprecedented size and scope. The original bill included $500 Billion for direct payments to Americans, $208 Billion for loans to major industries and $300 Billion in relief funds for small businesses. This bill was further expanded growing to what is believed to be around $2.0 to $2.5 Trillion in the version unanimously passed by Congress.

-

Phase 4 does not yet exist, but there are indications that another major stimulus of even greater size will likely be necessary to stabilize the economy and keep the economy from slipping into a deep recession. The scope and cost of such stimulus will become clearer as events unfold.

Global Stimulus / Recession

Similar stimulus efforts are occurring by governments globally to combat the impacts of the COVID-19 pandemic. It is largely accepted that we are either in or about to be in a global recession, which was imminent prior to the pandemic. The impacts of the pandemic will put the US economy into a recession. The depth and overall economic impact of that recession will be playing out over the coming days, weeks and months based on our ability get the economy restarted before a deep nasty recession smashes into the US and global economies.

US Outlook

Recently President Trump extended the national recommendation of social distancing, limits on gatherings, and closure of non-essential businesses through the end of April 2020. At the end of this timeframe, the US economy will have been largely shut down for about 6 weeks. This will be a major juncture that could dictate the depth to which this pandemic could impact the US and global economies. If the growth curve can be adequately flattened and testing ramped up to a major scale, there is a chance for rapid recovery in some sectors and avoidance of total collapse for some particularly hard-hit industries. It is anticipated the US Government will devise more stimulus programs at a historic cost to protect the integrity of the economy.

Anthony Fauci pictured above with President Donald Trump is an American immunologist and head of the U.S. National Institute of Allergy and Infectious Diseases. Dr. Fauci has been instrumental in his role on the Whitehouse Coronavirus Taskforce really towing the line for a science-based approach as the United State’s most effective measures to combat COVID-19.

Long Term Outlook / Race for the Cure

In general scientists agree that COVID-19 will not burn itself out; rather, it is here to stay until humans achieve heard immunity or an effective vaccine can be developed, tested, and deployed on a global scale. Even at lightning pace, mass distribution for any effective cure is at least 12 to 18 months out. Fortunately, the disease will likely fall off sharply during the summer and early fall months of 2020, and will re-emerge in hotspots throughout the US during the cooler seasons, which will necessitate enactment of extreme social distancing measures and trace sourcing at localized levels to beat back community spread. Control of the disease will require ongoing changes to our social behaviors, that rapid result wide-spread testing be available to the entire general public, and that medical advancement leads to methods of preventing and treating the disease more effectively to restore the confidence of the general public so that normal economic activities can return.

State of Oregon & Local Considerations

The state of Oregon is one of 42 states that is under some form of “stay-at-home” or “shelter-in-place” ordinance to promote extreme social distancing, which is recommended by scientists as an effective way to reduce community transmission, flatten the growth curve and create a manageable situation for the medical community. All businesses that are deemed non-essential have been asked to close, and residents are supposed to stay in their homes except for daily exterior exercising and trips for vital supplies at grocery and drugstores. Restaurants, bars and cafes are either closed or operating with take out or delivery services only. The state has been quick to aggressively protect the residential and commercial renters as summarized by the following events:

-

On March 22, 2020 OR Gov. Kate Brown put a 90-day statewide moratorium on residential evictions.

-

On April 2, 2020 OR Gov. Kate Brown put a 90-day statewide moratorium on commercial evictions.

These protective measures for the residential occupants and commercial tenants put the collective owners of investment residential and commercial real estate at inferior negotiating positions compared to letting the free market determine what is equitable. Regardless of the legal protection that is in place, it is logical for owners of investment properties to anticipate some sort of immediate near-term income loss, and continued income loss up to the point of economic recovery. With the State’s protection from evictions and with a large portion of the economy unable to work, it is anticipated that losses will be front loaded for the next 3 months at least, and then a period of recovery until the economy can regain stabilization. If the economy stays shut down for an extended period beyond what is currently planned, there could be much more severe consequences. Although the US Government is optimistically targeting a partial restart of the economy at the start of May 2020, most recent initiatives indicate that the state of Oregon does not foresee a return to typical economic conditions anytime soon.

-

On April 7, 2020, OR Gov. Kate Brown extended a statewide ban of dine-in service at restaurant and bars. The original executive order occurred March 17, 2020 and was set to expire in the less than one week from this extension, which is indefinite, remaining in effect “until terminated by the Governor.”

-

On April 8, 2020, OR Gov. Kate Brown extended the closure of all Oregon public schools through the end of the academic year.

-

As of April 8, 2020 the state of Oregon had 1,239 confirmed COVID-19 cases, and 37 deaths, which is 33 among US states for total confirmed cases and is one of a vast majority of states that has an infection rate in the vicinity of 1 per 100,000 residents.